Services

Credit Rating Advisory

I. Ratings Execution & Optimization

We support our clients throughout all stages of a ratings process: engaging with agencies, preparing for agency interviews, ensuring all appropriate supporting information and analysis is prepared and presented to agencies in the best possible light, We structure transactions to optimise credit outcomes and helping clients communicate ratings results to internal and external stakeholders. For rated clients we conduct scenario analyses: advice on potential changes to existing ratings based on proposed transactions or business plan changes.

II. Credit Ratings Assessment

For unrated clients we assess the likely outcome of a credit ratings process to support funding options advice or debt capital raising/refinancing transactions. We also optimize, unrated debt capital raising/refinancing transactions by assessing and communicating the likelihood of credit quality.

III. Securitisation

Securitisation is a ratings-driven funding structure. We act as independent financial advisor from the initial assessment phase of a securitisation right through to financial close.

FUND RAISING AND M&A

I. Ratings Execution & Optimization

— Our Offerings —

- Equity Raise

- Debt Syndication

- Structured Debt

- Mergers & Acquisitions

SERVICES

Information Memorandum -> Preparing detailed company analysis along with commentary on past performance and future projections.

Pitch Books -> Providing deal-related presentations that highlight the strategic/financial and operational details to the investors.

Company Teaser -> Preparing short presentations that outline transaction summaries, and business opportunities.

Business Plans -> Detailing new business opportunities, expected investments, return analysis, and growth expectations.

Financial Modeling & Valuation -> Building financial models for companies, projects, and businesses.

Investors Relations -> Assisting management in preparing quarterly, half-yearly and yearly updates for board meetings and investor relations.

RENEWABLES ENERGY SOLUTIONS FOR C&I SEGMENT

— Open Access ( Pan India ) —

- Group Captive model

- Third Party model

- Capex Model – End to End Solution covering from license to constructing complete solar project

— Roof Top / Ground Mounted —

- Opex model

- Capex model

ADVANTAGES

Energy Cost Saving -> Company will be able to save on grid power cost by implementing the solar plant for next 25 year.

Low Investments -> Company gets solar power with low equity contributions under group captive schemes.

Green Energy -> Up-to 70% of power requirement can be met out through solar energy reducing your carbon footprint.

Outsourced Model -> Developer takes responsibility for procurement, installation, permitting, operations and maintenance of the plant.

No Operating Risk -> Option for paying only per kWh generated, under OPEX Model.

High project returns -> Project payback period can be as low as 1.5 years delivering high equity and project level IRRs.

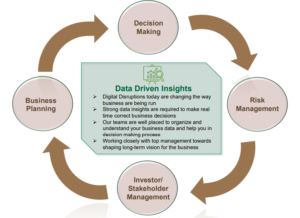

STRATEGIC CONSULTING

BTCALLP’s assignments encompass the spectrum of challenges facing today’s Indian Businesses. This gives our team an opportunity to build skills and gain knowledge and experience on critical strategic issues being faced by Indian corporates. This unique position of ours aids in helping our clients in building better businesses.

Given today’s ever changing scenarios at policy level, every business needs to evaluate and improve its risk-management capabilities. Risk management is the identification, quantification, and proactive management of risks—and it is a key factor for long term growth for every industry.

Some of the risks include credit risk generated by lending activities; market and counterparty risk generated by trading activities (notably, derivatives trading); liquidity risk generated by mismatched assets and liabilities; operational risk caused by error and omission in systems and processes.

Our teams helps in understanding of these risk factors and providing solutions towards mitigating each of these risk factors in close consultation with our clients. The key issues we try to address is How can an institution identify the most important risks it faces—and how can they be made transparent and managed?

Industries we serve

Textiles

Steel & Iron

Hospitals

Agrochemicals

Real Estate

Automobile

Engineering

Construction

Logistics

Logistics

Gems & Jewellery

Power

FMCG

Road Projects

Wires & Cable

Hotels